Money Confidence for International Students

Moving to Australia comes with enough stress. Your finances shouldn't add to it.

We work with students from over 40 countries who are figuring out Australian banking, budgeting in AUD, and managing money while studying full-time. Not lectures about spreadsheets—real strategies that actually fit your life.

Because understanding your money shouldn't require a translator.

I wish someone had explained Australian banking fees before I opened three different accounts trying to find the right one. Would've saved me $180 in those first two months.

What You're Actually Dealing With

Coming from different banking systems means things that seem simple to locals can be surprisingly complex. Here's what we help students sort out during their first year in Brisbane.

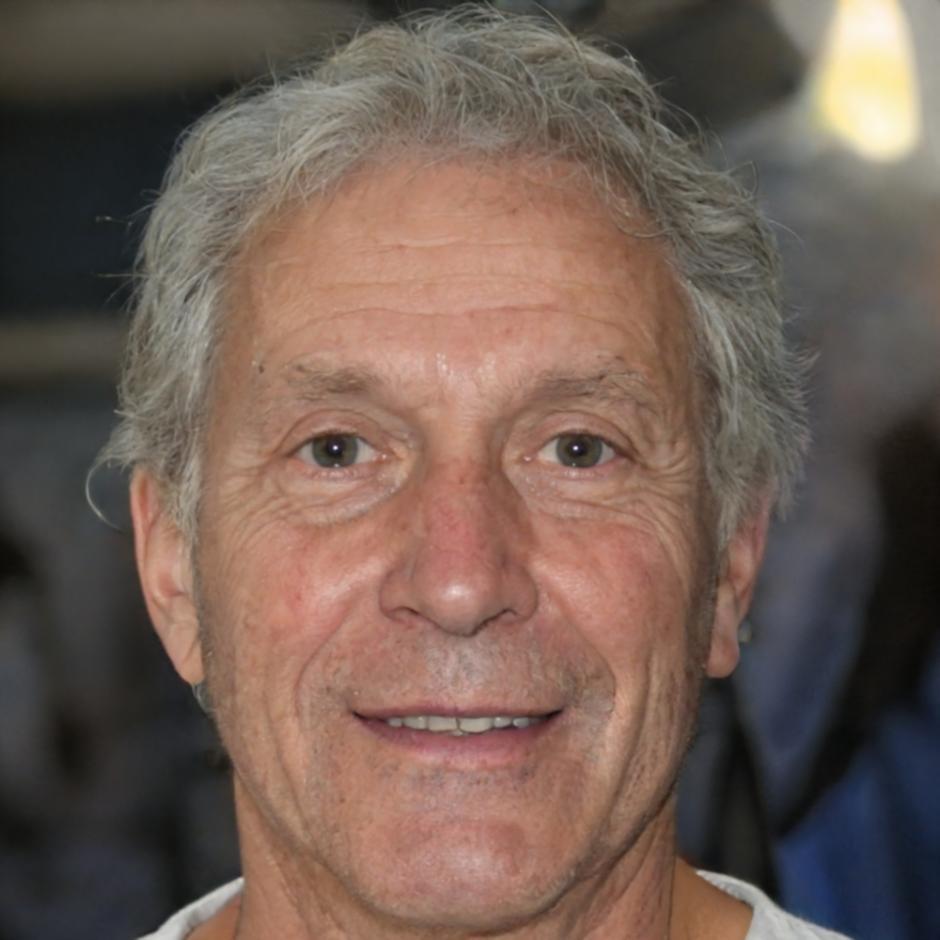

Working With Someone Who Gets It

Former exchange student who made every budgeting mistake possible during her own university years. Now helps others avoid the same expensive learning curve.

Your First Month Budget Review

Most students underestimate their first month costs by about 30%. We sit down before you arrive and map out realistic expenses—accommodation setup, textbooks, transport passes, phone plans.

Then we check in after your first few weeks to adjust based on what you're actually spending. Because Gold Coast living costs hit different than what the university brochures suggest.

Understanding Your Visa Work Rights

Student visa conditions changed in January 2025. You can work more hours now, but there are still restrictions during teaching periods versus breaks.

We help you understand how part-time income affects your budget planning, tax obligations, and what happens if you pick up extra shifts during holidays. No confusing government websites—just straight answers.

Planning for Home Visits and Travel

Flights back home during semester breaks can cost anywhere from $800 to $2400 depending on your destination. That's significant when you're budgeting on student income.

We help you set up savings goals that actually work, whether you're planning one trip home per year or hoping to explore Australia during your study breaks.

Getting Started This Year

We're running information sessions for international students throughout August-October 2025. Group workshops cover banking basics, then individual sessions dive into your specific situation.

Because your budgeting needs as a postgrad from Malaysia look different from an undergrad from Chile or a research student from Vietnam.

Book Your Session